Turn Merchant Payments into a BFSI-Owned Revenue Engine.

Most financial institutions process payments. Few actually own the margins.

Ascertain’s PayHub gives banks, financial institutions, and regulated BFSI organisations full control of the merchant payments business platform, data, pricing power, and revenue streams.

Powered by Ascertain.

For the financial institutions of tomorrow.

Turn Merchant Payments into a BFSI-Owned Revenue Engine.

Most financial institutions process payments. Few actually own the margins.

Ascertain’s PayHub gives banks, financial institutions, and regulated BFSI organisations full control of the merchant payments business platform, data, pricing power, and revenue streams.

Powered by Ascertain.

The Challenge

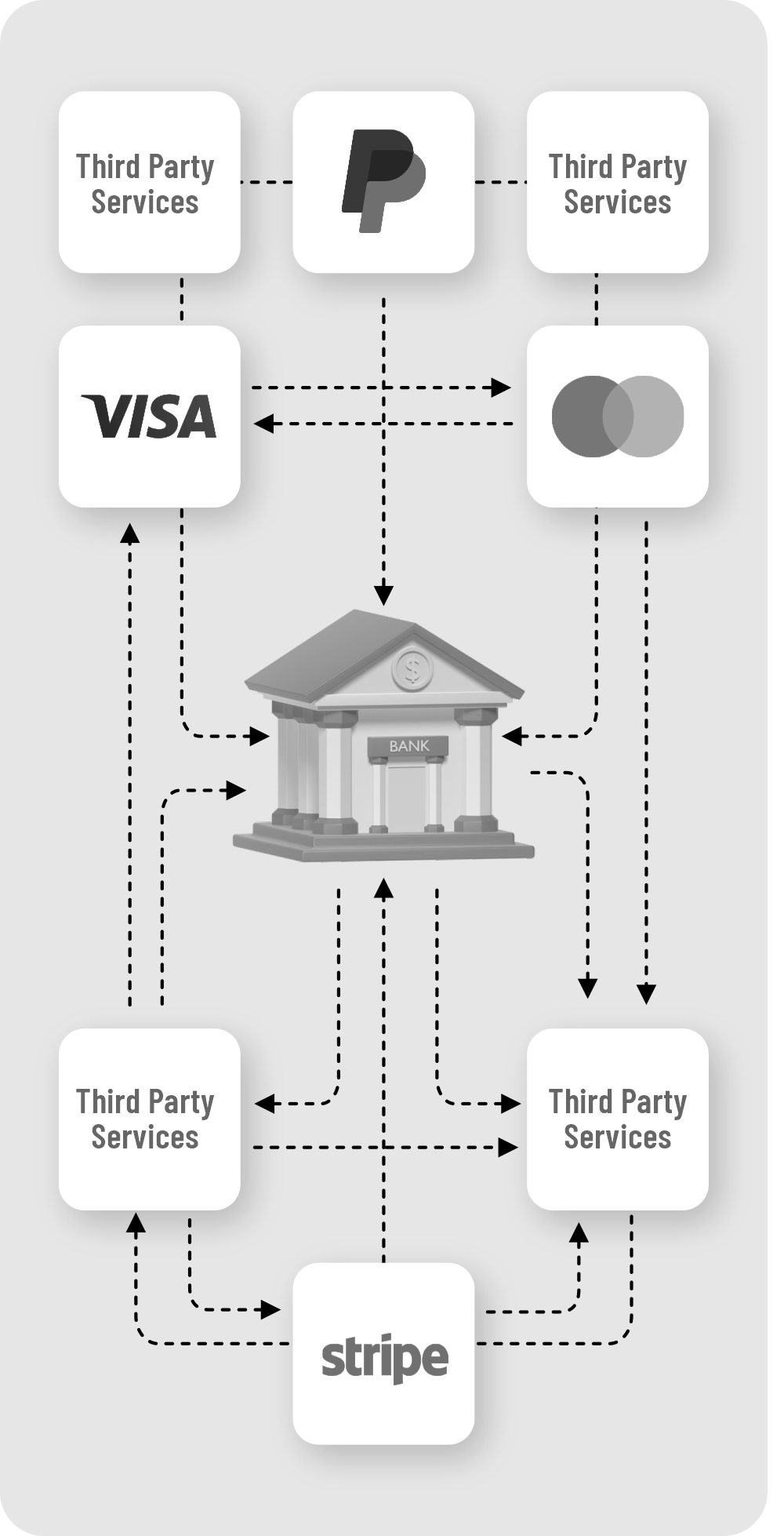

The Hidden Cost of Not Owning Your Merchant Payments Stack

Core Capabilities

Built for Banks and Financial Institutions of Tomorrow. Three Pillars That Deliver Revenue, Control & Growth

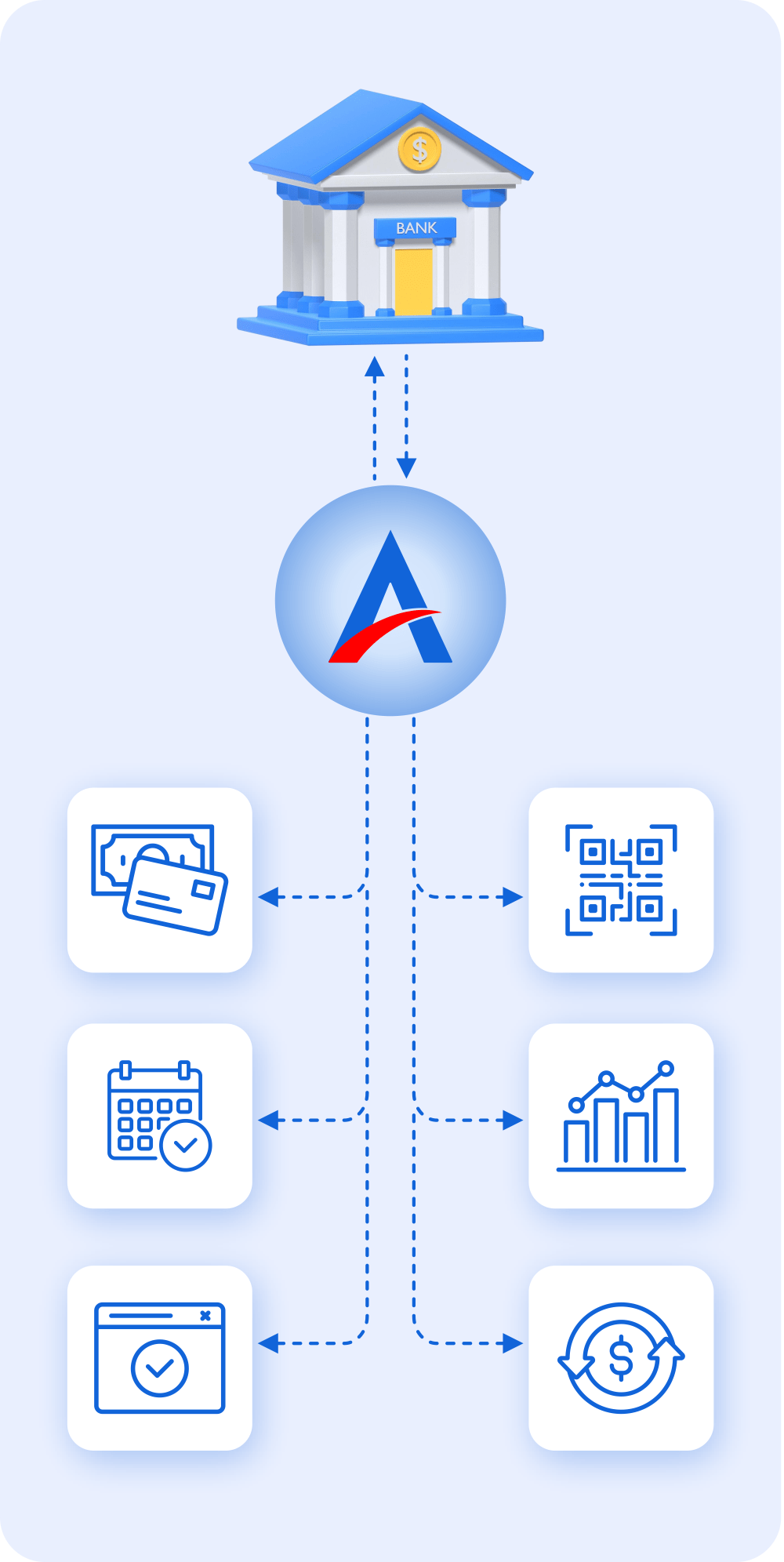

A Complete Merchant Payment Ecosystem, Owned by the Bank

Outcome: Faster revenue, lower operational risk, full control over margins.

Proven Impact

The ‘Ascertain’ Advantage: Global Significance, Proven Across Banking Partners

With insider expertise in BFSI and payments, we help banks tackle technology, operations, and scalability challenges seamlessly.

Fintech Expertise. Banking DNA.